Are you seeking a secure investment with competitive returns? Look no further than the best 3-month CD rate, designed to maximize your short-term savings.

When it comes to investing, short-term stability and reliable interest earnings are often sought-after qualities. Here, the best 3-month CD rate emerges as an ideal solution for those who prioritize preservation of principal and accessibility to funds.

Best 3-Month CD Rate Overview

A 3-month certificate of deposit (CD) is a type of savings account offered by banks and credit unions that provides a fixed interest rate for a 90-day period.

best 3 month cd 2024 Best 3-Month CD Rates – DollarGeek

Target of Best 3-Month CD Rate

The primary target of the best 3-month CD rate is to offer a secure and stable investment option for individuals and businesses seeking short-term returns.

best 3 month cd rates in michigan Top CD Rates July 2023 | Earn Up To 6.18% On A 3-Month CD – YouTube

Summary

The best 3-month CD rate combines the benefits of low risk, predictable interest earnings, and accessibility to funds within a short time frame, making it a compelling choice for conservative investors.

Personal Experience and Explanation

In my personal financial journey, I have utilized 3-month CDs as a safe haven for funds earmarked for short-term expenses or unexpected financial needs.

:max_bytes(150000):strip_icc()/certificateofdeposit-56c3326a5f9b5829f86afe9f.jpg)

best 3 month cd rates right now Best 3-Month CD Rates for November 2022

The fixed interest rate and short maturity period provide peace of mind, knowing that my savings are protected and earning a guaranteed return without market volatility concerns.

From a broader perspective, the best 3-month CD rate plays a crucial role in financial planning, offering stability to investment portfolios and providing a reliable source of income for individuals during market downturns.

History and Myth of Best 3-Month CD Rate

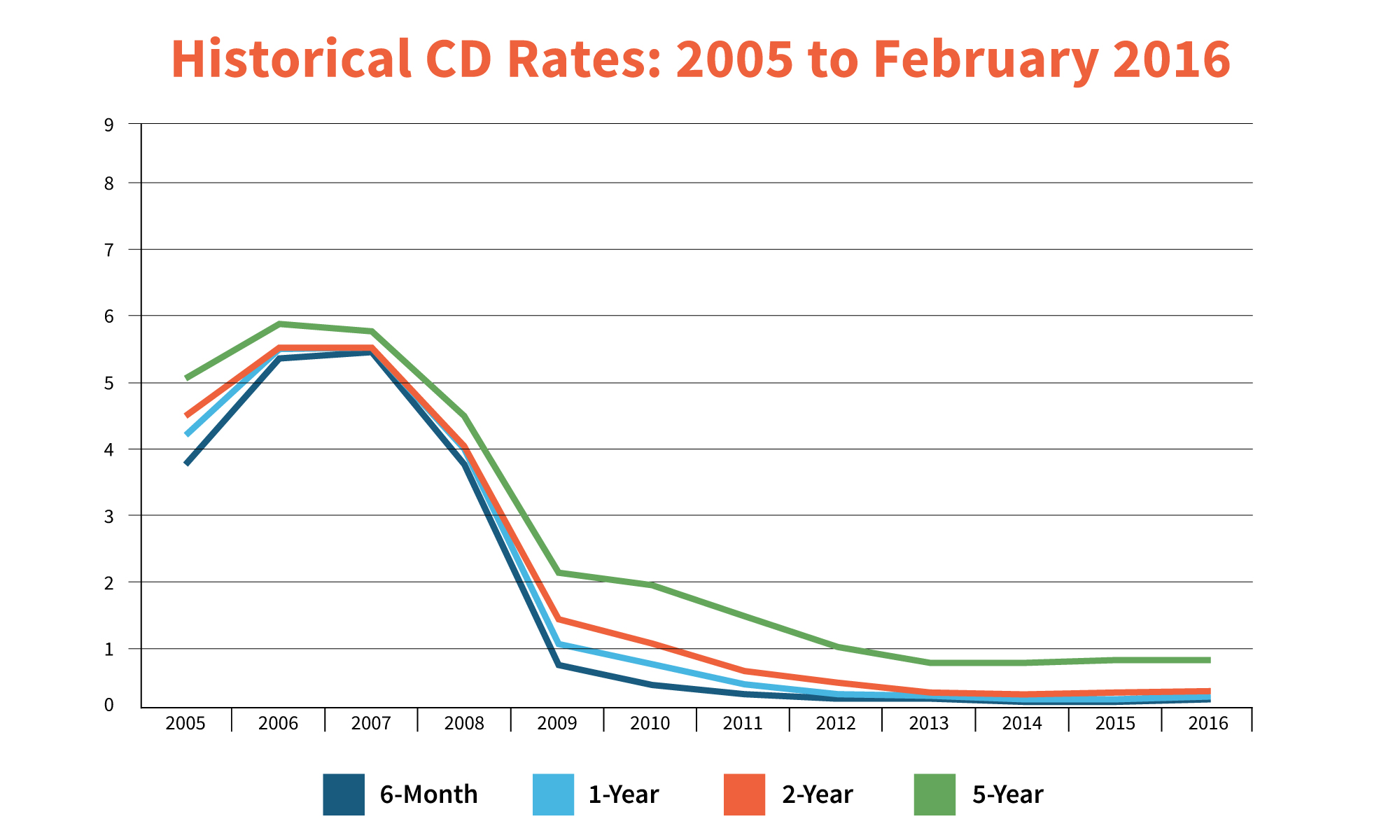

Historically, 3-month CDs have been a popular investment option for risk-averse individuals and institutions seeking stable returns.

best 3 month cd rates in florida Best 3-Month CD Rates (October 2023) – Doughroller

However, certain myths surround 3-month CDs, such as the notion that they offer negligible returns compared to other investments. In reality, while they may not yield the highest returns, they provide a competitive balance between risk and reward.

Understanding the historical significance and dispelling common misconceptions about 3-month CDs empowers investors to make informed decisions.

Hidden Secret of Best 3-Month CD Rate

Beyond their perceived simplicity, 3-month CDs hold a hidden secret: laddering.

best 3 month cd rates in ny cd interest rate forecast

By investing in multiple 3-month CDs with staggered maturity dates, investors can create a “ladder” that provides a steady stream of income and reduces interest rate risk.

This strategy involves purchasing several 3-month CDs at different times, ensuring that one CD matures each month, providing consistent access to funds and potentially higher average returns.

Recommendation of Best 3-Month CD Rate

When selecting the best 3-month CD rate, it’s essential to compare rates offered by various financial institutions.

best 3 month cd interest rates Top CD Rates Today: Best 3-Month Rate Rises, 18-Month Leader Drops

Online banks and credit unions often provide competitive rates due to lower overhead costs compared to traditional banks. Consider factors such as minimum deposit requirements, penalties for early withdrawal, and the institution’s reputation.

By comparing rates and understanding the terms and conditions, you can make an informed decision that aligns with your financial goals.

Benefits of Best 3-Month CD Rate and Related Keywords

The benefits of investing in the best 3-month CD rate extend beyond stable returns.

best 3 month cd rates in nj Best CD Rates Archives

- Low risk: 3-month CDs are a low-risk investment option, as they are backed by the FDIC up to $250,000 per depositor.

- Predictable interest earnings: With a fixed interest rate, you can accurately forecast your earnings and plan for future expenses.

- Short maturity period: The 90-day maturity period provides quick access to funds when needed.

Tips for Best 3-Month CD Rates

To maximize the benefits of 3-month CDs, consider these practical tips:

best 3 month cd rate today Best 3-Month CD Rates: Comparison

- Shop around: Compare rates offered by different banks and credit unions to secure the best possible return.

- Consider online banks: Often, online banks offer higher rates due to lower operating costs.

- Maximize your investment: Deposit as much as you can afford to earn higher interest earnings.

Best Practices for Best 3-Month CD Rate and Related Keywords

When investing in 3-month CDs, it’s wise to adopt best practices for effective management:

best 3 month cd today Best 3-Month CD Rates for June 2023

- Set financial goals: Determine how much you need to save and over what time frame.

- Choose the right maturity date: Select a maturity date that aligns with your financial needs.

- Monitor interest rates: Stay informed about market interest rates to identify opportunities for higher returns.

Fun Facts of Best 3-Month CD Rate

Here are some intriguing fun facts about 3-month CD rates:

- Historical high: The highest 3-month CD rate on record was 17.01% in June 1981.

- Historical low: The lowest 3-month CD rate on record was 0.01% in December 2008.

- Inflation impact: 3-month CD rates can fluctuate based on inflation rates.

How to Best 3-Month CD Rate

To invest in a 3-month CD, follow these steps:

- Research and compare: Compare rates offered by different financial institutions.

- Choose a provider: Select a bank or credit union that offers competitive rates and meets your needs.

- Open an account: Open a 3-month CD account and deposit your funds.

What If Best 3-Month CD Rate

Consider the following scenarios in relation to 3-month CD rates:

- Rates increase: If interest rates rise, you may consider opening a new 3-month CD at a higher rate.

- Rates decrease: If interest rates fall, you may want to hold onto your existing 3-month CD or consider a shorter-term CD.

- Need funds early: Early withdrawal from a 3-month CD may result in penalties.

Listicle of Best 3-Month CD Rate

Here’s a listicle summarizing the key aspects of 3-month CD rates:

- Short-term investment option with a 90-day maturity period

- Fixed interest rate for predictable earnings

- Low risk due to FDIC insurance up to $250,000

- Suitable for conservative investors seeking stable returns

- Compare rates and choose a reputable financial institution

Question and Answer on Best 3-Month CD Rate

Here are some frequently asked questions and answers about 3-month CD rates:

- What is a 3-month CD? A 3-month CD is a type of savings account that offers a fixed interest rate for a 90-day period.

- Is my money safe in a 3-month CD? Yes, 3-month CDs are insured by the FDIC up to $250,000 per depositor.

- What are the benefits of a 3-month CD? 3-month CDs offer low risk, predictable interest earnings, and short maturity.

- How do I open a 3-month CD? You can open a 3-month CD by contacting your bank or credit union.

Conclusion of Best 3-Month CD Rate

In conclusion, the best 3-month CD rate offers a compelling combination of security, stability, and accessibility, making it a valuable tool for short-term savings and investment strategies.

By understanding the key characteristics and leveraging the tips and recommendations provided, investors can harness the benefits of 3-month CDs and optimize their financial outcomes.