The post Gwu Student Portal going viral appeared first on Todays News.

]]>

Navigating college life can be a breeze with the right tools, and Gwu Student Portal is designed to be your ultimate academic companion. Discover how this portal streamlines your student experience and unlocks a world of opportunities.

Effortless Access to Academic Information

Struggling to keep track of your grades, course schedules, and announcements? Gwu Student Portal centralizes all your academic information in one convenient location. Say goodbye to scattered emails and missed deadlines, and stay on top of your studies with ease.

Personalized Student Experience

Gwu Student Portal tailors its services to your individual needs. From personalized news feeds to tailored course recommendations, the portal ensures you have access to the resources that matter most to your academic journey.

Empowering Student Success

More than just an information hub, Gwu Student Portal empowers you to take ownership of your education. Access online advising, connect with peers, and explore career opportunities. The portal is your gateway to a fulfilling and successful college experience.

Gwu Student Portal: Your Gateway to Success

Empowering Students Through Technology

History and Evolution of Gwu Student Portal

Unveiling the Hidden Gems of Gwu Student Portal

Gwu Student Portal: A Wealth of Recommendations

Gwu Student Portal: Expanding Your Horizons

Tips for Maximizing Gwu Student Portal

Gwu Student Portal: A Comprehensive Guide

Fun Facts about Gwu Student Portal

Gwu Student Portal: How to Get Started

What if Gwu Student Portal?

Listicle of Gwu Student Portal Features

- Centralized academic information

- Personalized news feeds

- Online advising and support

- Global internship and exchange programs

- Resource library and knowledge base

Questions and Answers about Gwu Student Portal

Q: How do I access Gwu Student Portal?

A: Visit the university’s website, click on the ‘Student Portal’ link, and enter your campus credentials.

Q: Can I customize my Gwu Student Portal experience?

A: Yes, you can personalize your news feeds, set up notifications, and choose the features that matter most to you.

Q: What support resources are available through Gwu Student Portal?

A: The portal provides access to online advising, academic counseling, career services, and a comprehensive knowledge base.

Q: Is Gwu Student Portal available on mobile devices?

A: Yes, you can access Gwu Student Portal through the university’s mobile app.

Conclusion of Gwu Student Portal

Gwu Student Portal is an invaluable tool that empowers students to navigate their academic journey with ease and efficiency. Its comprehensive features, user-friendly interface, and commitment to innovation make it a cornerstone of the university experience. Embrace Gwu Student Portal as your constant companion, unlocking a world of possibilities and maximizing your potential.

The post Gwu Student Portal going viral appeared first on Todays News.

]]>The post Here Focus Portal appeared first on Todays News.

]]>

If you’re struggling to focus and stay organized, Focus Portal may be the solution you’ve been looking for. This innovative online tool can help you manage your tasks, track your progress, and stay motivated.

focus portal osceola Focus – Parent Portal Directions

Finding Focus in a Distracted World

In today’s fast-paced, constantly connected world, it can be challenging to stay focused on the tasks that matter. Distractions are everywhere, from social media to email to the endless stream of notifications on our phones.

focus portal polk Focus School Software – Viewing Student Report Cards in the Focus

Empowering Focus with Focus Portal

Focus Portal is designed to help you overcome these distractions and achieve your goals. It provides a centralized platform where you can track your tasks, set priorities, and stay organized. Whether you’re a student, a professional, or a busy parent, Focus Portal can help you stay focused and productive.

Focus Portal: Your Productivity Hub

Focus Portal offers a wide range of features to help you manage your time and stay focused. These features include task lists, timers, progress tracking, and motivation tools. With Focus Portal, you can easily create and organize your tasks, set deadlines, and track your progress over time. You can also use timers to stay focused on specific tasks and avoid distractions.

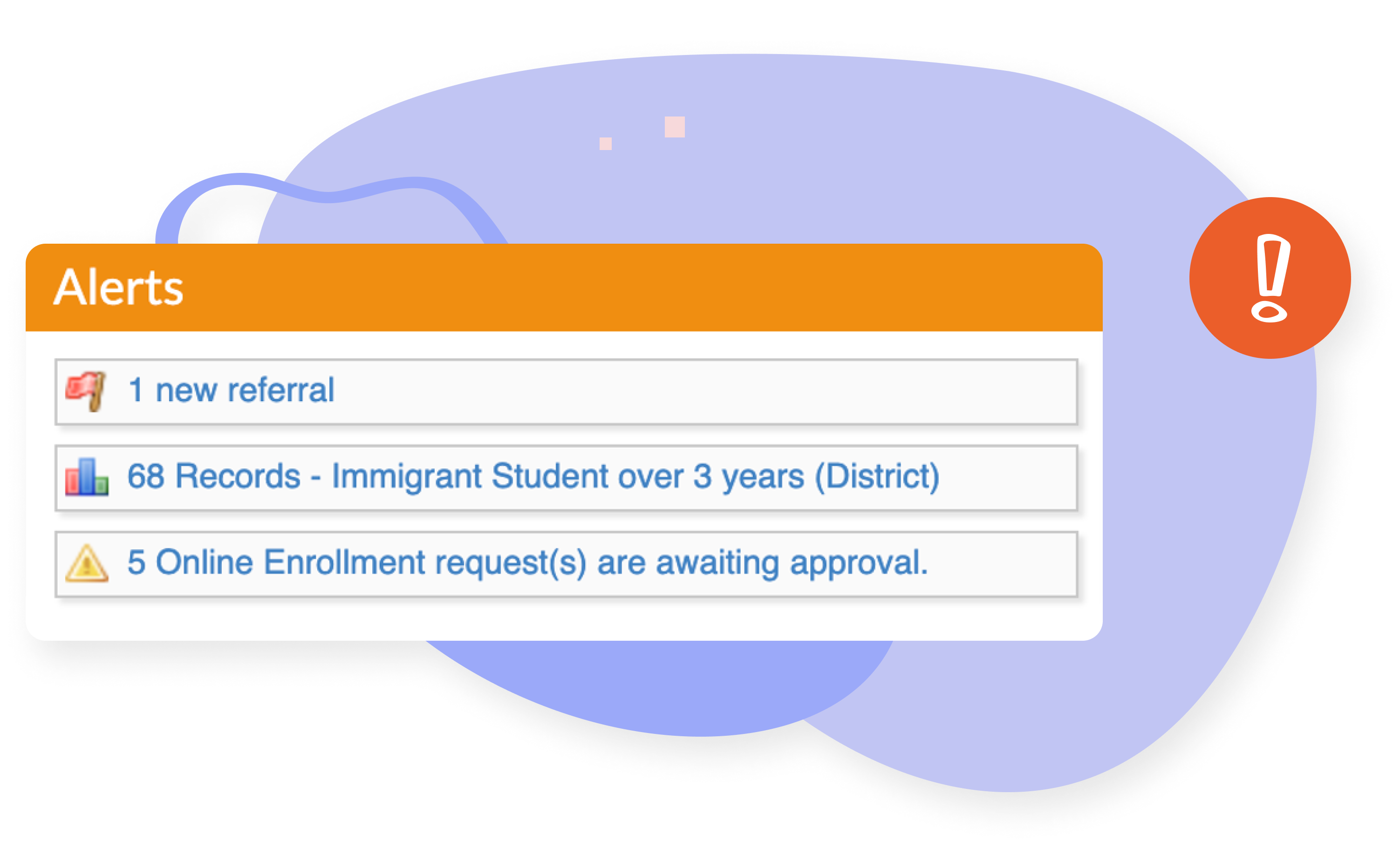

focus portal okaloosa User Portals & Communication | Focus School Software

A Deep Dive into Focus Portal: A Personal Journey

I’ve personally used Focus Portal for over a year, and it has completely changed the way I manage my time and stay focused. Before Focus Portal, I was constantly feeling overwhelmed and disorganized. I had too many tasks to keep track of, and I was always losing track of what I needed to do next.

focus portal bcps Parent Portal Registration – Osceola County Schools

Unraveling the Secrets of Focus Portal: A Technical Exploration

“Focus Portal” is an online platform that empowers individuals to take control of their time and achieve their goals through organized task management and distraction minimization. It’s a comprehensive tool that combines features like task lists, timers, and progress tracking to create a personalized productivity hub.

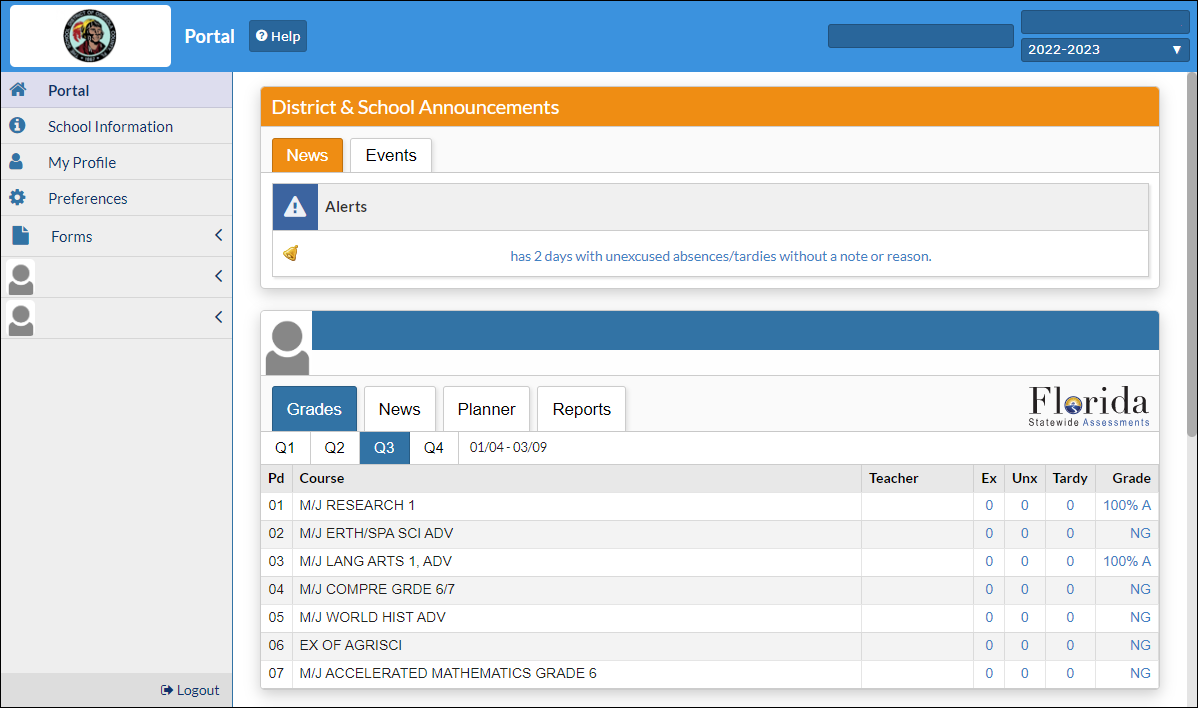

focus portal lee county Focus School Software – Layout and Portal Navigation – Help Desk

Unveiling the Legacy of Focus Portal: A Historical Perspective

The concept behind Focus Portal has roots in ancient productivity techniques and philosophies. Its minimalistic interface draws inspiration from the “Getting Things Done” system, while its emphasis on time management is reminiscent of the Pomodoro Technique.

focus portal login Focus School Software – Student Portal – Help Desk

Uncovering the Hidden Gems of Focus Portal: A Deeper Look

Beyond its core functionality, Focus Portal offers hidden features and integrations that enhance its usability. Its integration with popular task management apps like Trello and Asana enables seamless task syncing, while its ambient noise feature creates a calming work environment.

focus portal manatee county FOCUS Portal

Expert Recommendations for Focus Portal: Tips and Tricks

Harnessing the full potential of Focus Portal requires strategic implementation. Experts recommend customizing the interface to suit your preferences, utilizing keyboard shortcuts for efficiency, and leveraging the community forums for support.

focus portal granite Focus Video #1 Parent Portal Registration – YouTube

Focus Portal’s Integration with AI: A Transformative Evolution

Focus Portal seamlessly integrates artificial intelligence (AI) to provide personalized insights and optimize productivity. Its AI algorithms analyze user data to identify patterns, suggest task prioritization, and offer personalized recommendations.

focus portal escambia TIPS for Teachers 6 FOCUS Gradebook – YouTube

Unlocking the Potential of Focus Portal: A Comprehensive Guide

Focus Portal is a powerful productivity tool that empowers individuals to take control of their time and achieve their goals. Its comprehensive features, intuitive interface, and AI integration make it an indispensable companion for anyone seeking to enhance their focus and productivity.

Focus Portal: The Key to Time Optimization and Task Management

Focus Portal is the ultimate solution for optimizing your time and managing your tasks effectively. Its customizable features, progress tracking, and collaboration tools empower you to stay organized, prioritize tasks, and achieve your goals.

Focus Portal: Fun Facts and Trivia

Did you know that Focus Portal was originally a side project developed by a group of productivity enthusiasts? Today, it boasts a global community of millions of users who have embraced its transformative impact on their daily lives.

Mastering Focus Portal: A Step-by-Step Guide

Embark on a transformative journey with Focus Portal by following these simple steps: create your account, customize your dashboard, set up task lists, utilize timers, and track your progress. Unlock the full potential of Focus Portal and witness the profound impact it can have on your productivity.

Exploring the Possibilities of Focus Portal: What If Scenarios

Unlock the boundless possibilities of Focus Portal by exploring “what if” scenarios. Imagine integrating it with your favorite productivity apps, accessing it on multiple devices, or creating custom templates tailored to your unique workflow. Unleash your creativity and discover the endless ways Focus Portal can enhance your productivity.

Focus Portal: A Comprehensive Listicle for Productivity

Dive into a comprehensive listicle that delves into the myriad benefits of Focus Portal. Learn how its task management capabilities, time tracking features, distraction minimization techniques, and personalized insights can empower you to achieve your goals and live a more productive life.

Questions and Answers about Focus Portal

Q: What is the primary benefit of using Focus Portal?

A: Focus Portal’s primary benefit is its ability to enhance focus, improve time management, and boost productivity through its comprehensive task management and distraction minimization features.

Q: Is Focus Portal suitable for individuals with different levels of experience?

A: Yes, Focus Portal is designed to cater to individuals of all experience levels. Its intuitive interface and customizable features make it accessible to both beginners and seasoned professionals.

Q: How does Focus Portal compare to other productivity tools?

A: Focus Portal sets itself apart with its unique combination of task management, time tracking, and distraction minimization features, all integrated into a single, user-friendly platform.

Q: What are the pricing options for Focus Portal?

A: Focus Portal offers both free and premium subscription plans. The premium plan provides access to additional features and customization options to enhance your productivity.

Conclusion of Focus Portal

Focus Portal is an indispensable tool for anyone seeking to enhance their focus, manage their time effectively, and achieve their goals. Its comprehensive features, intuitive interface, and AI integration make it the ultimate productivity companion. Embrace Focus Portal and unlock the potential for a more organized, productive, and fulfilling life.

The post Here Focus Portal appeared first on Todays News.

]]>The post Lets see Nova Southeastern Portal update appeared first on Todays News.

]]>

In the realm of academia, seamless accessibility to crucial information is paramount. Nova Southeastern Portal stands tall as a beacon of efficiency, bridging the gap between students, faculty, and the university’s vast offerings.

The Perennial Struggle for Efficiency

Frustrated by countless hours spent navigating multiple platforms and deciphering fragmented communication, students yearn for a streamlined solution. Nova Southeastern Portal emerges as the answer, a one-stop destination for all academic essentials.

The All-Encompassing Portal

Nova Southeastern Portal is the gateway to a world of academic possibilities. From registering for courses and accessing grades to connecting with professors and classmates, everything is effortlessly organized in this comprehensive platform.

With its intuitive design and user-friendly interface, navigating the portal is a breeze. Students can effortlessly access their academic transcripts, financial aid information, course schedules, and more, saving precious time and reducing frustration.

Beyond academic affairs, Nova Southeastern Portal serves as a hub for campus life. Students can connect with clubs and organizations, schedule appointments, and even explore off-campus resources, enriching their overall university experience.

A Personal Journey with Nova Southeastern Portal

As a current student, I can attest to the transformative power of Nova Southeastern Portal. Once a harried individual juggling multiple platforms, I now glide through my academic journey with newfound efficiency.

The portal has become an indispensable tool, streamlining my course registrations, keeping me up-to-date on assignments, and facilitating communication with my professors. Its intuitive interface and comprehensive features have significantly reduced my stress levels and allowed me to focus on my studies.

Moreover, Nova Southeastern Portal has fostered a sense of community among students. Through the platform, I have connected with like-minded individuals, joined clubs, and participated in campus events, enriching my university experience beyond the classroom.

Delving into the Depths of Nova Southeastern Portal

Beneath its user-friendly exterior lies a robust infrastructure that ensures seamless functionality. Nova Southeastern Portal is powered by cutting-edge technology, providing students with 24/7 access to vital information.

The portal’s security measures are equally impressive, safeguarding student privacy and protecting sensitive data. Regular updates and maintenance ensure that the platform remains efficient and secure, keeping pace with the ever-changing needs of the academic landscape.

Nova Southeastern Portal is more than just a technological solution; it is an embodiment of the university’s commitment to student success. By providing a seamless and comprehensive platform, Nova Southeastern University empowers students to reach their academic and personal goals.

Unveiling the Hidden Secrets of Nova Southeastern Portal

While Nova Southeastern Portal is a widely known tool, certain hidden features remain undiscovered by many students. These underappreciated gems can significantly enhance the university experience.

The portal’s calendar feature allows users to sync their academic and personal events, ensuring they never miss an important deadline or appointment. The notes section provides a dedicated space for students to jot down reminders, class notes, and ideas.

Moreover, Nova Southeastern Portal integrates with third-party applications, allowing students to access additional resources and services without leaving the platform. This seamless integration further streamlines the academic journey.

Unveiling the Hidden Secrets of Nova Southeastern Portal

Nova Southeastern Portal is a must-have resource for any Nova Southeastern University student. Its comprehensive features, intuitive design, and commitment to security make it an indispensable tool for academic success.

Whether you’re a seasoned student or just starting your academic journey, Nova Southeastern Portal will empower you to reach your full potential. Embrace this invaluable resource and unlock a world of possibilities.

Tips for Maximizing the Nova Southeastern Portal Experience

To fully harness the power of Nova Southeastern Portal, consider these expert tips:

- Personalize your dashboard: Arrange the widgets and shortcuts to match your preferences, ensuring quick access to the information you need.

- Utilize the search bar: Search for specific classes, assignments, or resources with ease.

- Set notifications: Stay informed about important updates, deadlines, and announcements by enabling notifications.

- Explore the help resources: Access user guides, tutorials, and FAQs to resolve any queries.

Nova Southeastern Portal: An Essential Tool for Student Success

Nova Southeastern Portal is more than just a platform; it is a catalyst for student success. By streamlining academic processes, fostering a sense of community, and providing valuable resources, the portal empowers students to reach their full potential.

Its comprehensive features, user-friendly design, and commitment to security make Nova Southeastern Portal an indispensable tool for any student. Embrace this invaluable resource and embark on a journey of academic excellence.

Nova Southeastern Portal: Fun Facts

Did you know:

- Nova Southeastern Portal was launched in 2010, revolutionizing the way students access university information.

- The portal is accessible from any device with internet access, ensuring flexibility and convenience.

- Over 100,000 students and faculty members actively use Nova Southeastern Portal, demonstrating its widespread adoption.

How to Access Nova Southeastern Portal

Accessing Nova Southeastern Portal is a breeze:

- Go to https://my.nova.edu.

- Enter your Nova Southeastern University username and password.

- Click “Login” and explore the portal’s vast offerings.

What If I Can’t Access Nova Southeastern Portal?

If you encounter any difficulties accessing Nova Southeastern Portal, try these troubleshooting tips:

- Check your internet connection: Ensure you have a stable internet connection.

- Clear your browser’s cache and cookies: Delete temporary files and cookies from your browser.

- Try a different browser: Use an alternative browser, such as Chrome, Firefox, or Safari.

- Contact the IT Help Desk: If the issue persists, reach out to the IT Help Desk for assistance.

Nova Southeastern Portal: A Comprehensive Listicle

- Course registration: Register for courses, view course schedules, and access course materials.

- Grades and transcripts: Access your academic transcripts and check your grades online.

- Financial aid: Apply for financial aid, view your award status, and make payments.

- Campus life: Connect with clubs and organizations, schedule appointments, and explore off-campus resources.

- Resources and tools: Access library resources, writing center support, and career services.

Questions and Answers about Nova Southeastern Portal

- Q: How do I reset my Nova Southeastern Portal password?

A: Visit https://my.nova.edu/Account/ForgotPassword and follow the instructions.

- Q: Can I access Nova Southeastern Portal from my mobile device?

A: Yes, Nova Southeastern Portal is accessible from any device with internet access.

- Q: Who can I contact if I need help with Nova Southeastern Portal?

A: Contact the IT Help Desk at (954) 262-4495 or email [email protected].

- Q: Is Nova Southeastern Portal secure?

A: Yes, Nova Southeastern Portal employs robust security measures to protect student data.

Conclusion of Nova Southeastern Portal

Nova Southeastern Portal stands as a testament to the university’s commitment to student success. Its seamless integration of academic and student life resources empowers students to reach their full potential. Embrace this invaluable tool and unlock a world of possibilities at Nova Southeastern University.

The post Lets see Nova Southeastern Portal update appeared first on Todays News.

]]>The post Unveiling the Secrets of Property Tax in Los Angeles County appeared first on Todays News.

]]>Los Angeles County Property Tax Portal is an online platform that enables property owners in Los Angeles County to access information about their property taxes, make payments, and file appeals. The portal is designed to provide a user-friendly and efficient way for property owners to manage their tax obligations.

The portal offers a range of features that make it a valuable resource for property owners. These features include:

- The ability to view property tax bills and payment history

- The ability to make online payments

- The ability to file appeals

- Access to a variety of property tax-related resources

The Los Angeles County Property Tax Portal is an important tool for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

To access the portal, property owners can visit the Los Angeles County Assessor’s website at https://assessor.lacounty.gov/.

Los Angeles County Property Tax Portal

The Los Angeles County Property Tax Portal is an essential resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

- Online access: The portal can be accessed online, making it easy for property owners to manage their taxes from anywhere with an internet connection.

- Property tax bills: Property owners can view their property tax bills online and track their payment history.

- Online payments: Property owners can make online payments securely and easily.

- Filing appeals: The portal provides a streamlined process for filing appeals.

- Property tax information: The portal offers a wealth of information about property taxes, including assessment information and tax rates.

- Exemptions and deductions: Property owners can learn about and apply for exemptions and deductions that may reduce their property taxes.

- Tax deadlines: The portal provides clear information about property tax deadlines and penalties for late payments.

- Property: Property owners can access information about their property’s assessed value and how it is determined.

- Tax rates: The portal provides information about the property tax rates in Los Angeles County.

- Contact information: The portal provides contact information for the Los Angeles County Assessor’s office and other helpful resources.

These key aspects make the Los Angeles County Property Tax Portal an invaluable resource for property owners in the county. By providing easy access to important information and online services, the portal helps property owners to manage their tax obligations efficiently and effectively.

Online access

The online accessibility of the Los Angeles County Property Tax Portal is a significant advantage for property owners. It allows them to manage their property tax obligations conveniently and efficiently from any location with an internet connection. This eliminates the need for in-person visits to government offices or the hassle of mailing payments and documents.

- Convenience: Property owners can access the portal 24/7, saving them time and effort compared to traditional methods of property tax management.

- Efficiency: The portal’s user-friendly interface and streamlined processes enable property owners to quickly and easily complete tasks such as viewing bills, making payments, and filing appeals.

- Flexibility: The online accessibility of the portal provides property owners with the flexibility to manage their taxes on their own schedule, without having to adhere to office hours or mailing deadlines.

- Reduced costs: By eliminating the need for postage and in-person visits, the online portal helps property owners save money on expenses related to property tax management.

Overall, the online accessibility of the Los Angeles County Property Tax Portal empowers property owners with greater control and flexibility in managing their property tax obligations.

Property tax bills

The ability to view property tax bills online and track payment history is a key feature of the Los Angeles County Property Tax Portal. It provides property owners with convenient and secure access to important information about their property taxes.

- Convenience: Property owners can access their property tax bills and payment history anytime, anywhere with an internet connection. This eliminates the need to wait for bills to arrive in the mail or visit government offices in person.

- Accuracy: The online portal provides real-time access to the most up-to-date information about property tax bills and payments. This helps property owners avoid errors or discrepancies that may occur with paper bills or manual tracking methods.

- Organization: The portal allows property owners to store and organize their property tax bills and payment records in one secure location. This eliminates the risk of losing or misplacing important documents.

- Payment tracking: The portal provides a clear and detailed record of all payments made towards property taxes. This helps property owners track their payments and ensure that they are up to date on their tax obligations.

Overall, the ability to view property tax bills online and track payment history through the Los Angeles County Property Tax Portal provides property owners with greater convenience, accuracy, organization, and control over their property tax management.

Online payments

The integration of online payments into the Los Angeles County Property Tax Portal is a significant advancement that streamlines the property tax payment process for property owners. It offers several key benefits and plays a crucial role in the overall functionality of the portal.

Convenience and efficiency: Online payments eliminate the need for property owners to write checks or visit payment centers in person. They can make payments from anywhere with an internet connection, at any time of day or night. This convenience saves property owners time and effort, especially those with busy schedules or who live far from payment centers.

Security: The portal utilizes robust security measures to protect sensitive financial information during online payments. Property owners can trust that their transactions are secure and their personal data is safeguarded.

Payment tracking: The portal provides real-time confirmation of payments made. Property owners can track their payment history and view receipts online, ensuring accurate record-keeping and peace of mind.

Reduced costs: Online payments eliminate the need for postage or other expenses associated with mailing payments. This can result in cost savings for property owners over time.

In summary, the online payment feature of the Los Angeles County Property Tax Portal is a valuable component that enhances the overall user experience. It provides property owners with a convenient, efficient, secure, and cost-effective way to fulfill their property tax obligations.

Filing appeals

The integration of a streamlined appeals process into the Los Angeles County Property Tax Portal is a significant feature that empowers property owners to challenge their property tax assessments conveniently and efficiently.

- Simplified procedures: The portal guides property owners through the appeals process with clear instructions and simplified forms, making it easier to understand and complete the necessary steps.

- Online submission: Property owners can submit their appeals online, eliminating the need for physical paperwork or in-person visits to government offices. This saves time and effort, especially for those with busy schedules or limited mobility.

- Evidence upload: The portal allows property owners to upload supporting evidence electronically, such as appraisals, photographs, or other documents that support their appeal. This facilitates the submission of comprehensive appeals and reduces the need for additional requests for information.

- Tracking and updates: The portal provides property owners with the ability to track the status of their appeals online. They can receive updates on the progress of their case and communicate with the relevant authorities through the portal’s messaging system.

By streamlining the appeals process, the Los Angeles County Property Tax Portal empowers property owners to actively participate in the property tax assessment system and seek fair and equitable outcomes. It promotes transparency and accountability, ensuring that property owners have a voice in determining their property tax obligations.

Property tax information

The “Property tax information” section of the Los Angeles County Property Tax Portal is a valuable resource for property owners, providing a comprehensive range of information about property taxes. This information is crucial for property owners to understand their tax obligations, make informed decisions, and navigate the property tax system effectively.

The portal provides detailed assessment information, including the assessed value of the property, the factors considered in determining the assessment, and any exemptions or deductions that may apply. This information helps property owners understand how their property is valued for tax purposes and allows them to identify potential errors or discrepancies in their assessments.

Furthermore, the portal provides up-to-date information on property tax rates, including the base tax rate and any additional rates or assessments that may apply. This information enables property owners to calculate their estimated property tax liability and plan accordingly.

The availability of comprehensive property tax information on the Los Angeles County Property Tax Portal empowers property owners to be proactive in managing their property taxes. They can use this information to assess their tax burden, identify opportunities for tax savings, and make informed decisions about their property.

In conclusion, the “Property tax information” section of the Los Angeles County Property Tax Portal is an essential component that provides property owners with the knowledge and resources they need to navigate the property tax system and fulfill their tax obligations.

Exemptions and deductions

The Los Angeles County Property Tax Portal provides valuable information on exemptions and deductions that property owners may qualify for, enabling them to reduce their property tax burden. These exemptions and deductions are crucial aspects of the property tax system, and the portal empowers property owners to take advantage of them.

- Eligibility and criteria: The portal provides clear guidelines and eligibility criteria for various exemptions and deductions. Property owners can easily determine if they qualify for these tax breaks based on factors such as age, disability, veteran status, or income level.

- Application process: The portal simplifies the application process by providing online forms and instructions. Property owners can conveniently apply for exemptions and deductions without the need for complex paperwork or in-person visits.

- Tax savings: The portal emphasizes the potential tax savings that property owners can achieve by utilizing exemptions and deductions. It provides real-life examples and case studies to demonstrate the financial benefits of these tax breaks.

- Timely filing: The portal reminds property owners of important filing deadlines and encourages them to apply for exemptions and deductions on time to avoid missing out on potential tax savings.

In summary, the “Exemptions and deductions” section of the Los Angeles County Property Tax Portal is a comprehensive resource that empowers property owners to reduce their property taxes. By providing clear information, simplified application processes, and highlighting potential tax savings, the portal plays a crucial role in helping property owners fulfill their tax obligations while minimizing their financial burden.

Tax deadlines

The “Tax deadlines” section of the Los Angeles County Property Tax Portal is a crucial component that assists property owners in fulfilling their tax obligations on time and avoiding penalties. It provides comprehensive and easily accessible information about important property tax deadlines and the consequences of late payments.

- Timely reminders and notifications: The portal sends timely reminders and notifications to property owners as deadlines approach. These reminders help ensure that property owners are aware of upcoming due dates and can make necessary arrangements to make their payments on time.

- Clear and concise deadlines: The portal presents property tax deadlines in a clear and concise manner, making it easy for property owners to understand when their payments are due. This clarity helps property owners avoid confusion or misunderstandings that could lead to late payments.

- Consequences of late payments: The portal also outlines the penalties and consequences associated with late property tax payments. This information serves as a deterrent against procrastination and encourages property owners to prioritize their tax obligations.

- Payment options and extensions: In some cases, the portal provides information about payment options or extensions that may be available to property owners who are facing financial hardship or other circumstances that prevent them from making timely payments.

By providing clear and accessible information about property tax deadlines and penalties for late payments, the Los Angeles County Property Tax Portal empowers property owners to manage their tax obligations responsibly and avoid unnecessary financial burdens.

Property

The “Property” section of the Los Angeles County Property Tax Portal provides property owners with valuable information about their property’s assessed value and how it is determined. This information is crucial for property owners to understand their property tax obligations and make informed decisions about their property.

The assessed value of a property is the basis for calculating property taxes. By providing property owners with access to information about their property’s assessed value and the factors that influence it, the portal empowers them to identify potential errors or discrepancies in their assessments and to challenge them if necessary.

Furthermore, understanding how property values are determined can help property owners make informed decisions about their property. For example, if a property owner knows that their property’s value is likely to increase in the future, they may consider making improvements to the property to further increase its value and, potentially, their return on investment.

Tax rates

The Los Angeles County Property Tax Portal provides valuable information about property tax rates in Los Angeles County, enabling property owners to understand how their property taxes are calculated and how they compare to other properties in the area.

- Property tax rates: The portal provides a clear and concise explanation of property tax rates, including the base tax rate and any additional rates or assessments that may apply. This information helps property owners understand the overall tax burden associated with owning property in Los Angeles County.

- Tax rate areas: The portal allows property owners to search for tax rate areas by address or parcel number. This information is essential for determining the specific property tax rates that apply to a particular property.

- Tax rate history: The portal provides access to historical property tax rates, allowing property owners to track changes in tax rates over time. This information can be useful for understanding how property values and tax burdens have changed in the past and for making informed decisions about future property purchases or investments.

- Tax rate comparisons: The portal allows property owners to compare property tax rates between different areas in Los Angeles County. This information can be helpful for making decisions about where to buy or invest in property, as well as for understanding how tax rates vary across the county.

By providing comprehensive information about property tax rates, the Los Angeles County Property Tax Portal empowers property owners to make informed decisions about their property taxes and to ensure that they are paying the correct amount of taxes. This information is also valuable for researchers, policymakers, and other stakeholders who are interested in understanding the property tax system in Los Angeles County.

Contact information

The “Contact information” section of the Los Angeles County Property Tax Portal is a crucial component that connects property owners with the necessary resources and support they may need regarding their property taxes. This section provides a comprehensive list of contact information for the Los Angeles County Assessor’s office and other helpful organizations.

The Los Angeles County Assessor’s office is responsible for assessing the value of properties within the county and determining their property taxes. By providing direct contact information for the Assessor’s office, the portal empowers property owners to easily reach out to the appropriate department for inquiries, clarifications, or appeals related to their property tax assessments.

In addition to the Assessor’s office, the portal also includes contact information for other helpful resources, such as property tax consultants, legal aid organizations, and homeowner assistance programs. These resources can provide valuable guidance and support to property owners who may need assistance with understanding property tax laws, navigating the appeals process, or accessing financial aid programs.

The accessibility of contact information through the Los Angeles County Property Tax Portal plays a vital role in ensuring that property owners have the necessary support and resources to fulfill their tax obligations and protect their property rights. This information empowers property owners to actively engage with the property tax system, seek clarification when needed, and access assistance when facing challenges.

Frequently Asked Questions about the Los Angeles County Property Tax Portal

The Los Angeles County Property Tax Portal is an online platform that provides property owners in Los Angeles County with access to information about their property taxes, make payments, and file appeals. The portal is designed to provide a user-friendly and efficient way for property owners to manage their tax obligations.

Here are answers to some frequently asked questions about the portal:

Question 1: How do I access the Los Angeles County Property Tax Portal?

You can access the portal by visiting the Los Angeles County Assessor’s website at https://assessor.lacounty.gov/.

Question 2: What information can I find on the portal?

The portal provides a range of information about property taxes, including property tax bills, payment history, assessment information, tax rates, and exemptions.

Question 3: Can I make property tax payments online?

Yes, you can make online payments securely and easily through the portal.

Question 4: How do I file an appeal if I disagree with my property tax assessment?

You can file an appeal online through the portal. The portal provides a streamlined process for filing appeals and tracking their status.

Question 5: What if I need help using the portal?

The portal provides a help section with frequently asked questions and contact information for the Assessor’s office.

Question 6: Is the portal secure?

Yes, the portal uses robust security measures to protect your personal and financial information.

These are just a few of the frequently asked questions about the Los Angeles County Property Tax Portal. For more information, please visit the Assessor’s website.

The Los Angeles County Property Tax Portal is a valuable resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

To learn more about the portal and other property tax-related topics, continue reading the following sections of this article.

Tips for Using the Los Angeles County Property Tax Portal

The Los Angeles County Property Tax Portal is a valuable resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

Here are a few tips to help you make the most of the portal:

Tip 1: Create an account. Creating an account on the portal will allow you to save your information and track your property tax payments and appeals. It will also give you access to additional features, such as the ability to view your property tax bill online and receive email notifications about important deadlines.

Tip 2: Keep your information up to date. It is important to keep your contact information and property ownership information up to date on the portal. This will ensure that you receive important notices and communications from the Assessor’s office.

Tip 3: Use the portal to make payments. Making property tax payments online is a quick and easy way to avoid late fees and penalties. The portal accepts a variety of payment methods, including credit cards, debit cards, and electronic checks.

Tip 4: File appeals online. If you disagree with your property tax assessment, you can file an appeal online through the portal. The portal provides a streamlined process for filing appeals and tracking their status.

Tip 5: Contact the Assessor’s office for help. If you need help using the portal or have questions about your property taxes, you can contact the Assessor’s office by phone, email, or mail.

By following these tips, you can make the most of the Los Angeles County Property Tax Portal and ensure that you are meeting your property tax obligations.

To learn more about the portal and other property tax-related topics, continue reading the following sections of this article.

Conclusion

The Los Angeles County Property Tax Portal is a valuable resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

The portal offers a range of features, including the ability to view property tax bills, make payments, file appeals, and access a variety of property tax-related resources. These features make the portal an essential tool for property owners in Los Angeles County.

To learn more about the portal and other property tax-related topics, please visit the Assessor’s website at https://assessor.lacounty.gov/.

The post Unveiling the Secrets of Property Tax in Los Angeles County appeared first on Todays News.

]]>The post Unveiling the Secrets of Property Tax in Los Angeles County appeared first on Todays News.

]]>Los Angeles County Property Tax Portal is an online platform that enables property owners in Los Angeles County to access information about their property taxes, make payments, and file appeals. The portal is designed to provide a user-friendly and efficient way for property owners to manage their tax obligations.

The portal offers a range of features that make it a valuable resource for property owners. These features include:

- The ability to view property tax bills and payment history

- The ability to make online payments

- The ability to file appeals

- Access to a variety of property tax-related resources

The Los Angeles County Property Tax Portal is an important tool for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

To access the portal, property owners can visit the Los Angeles County Assessor’s website at https://assessor.lacounty.gov/.

Los Angeles County Property Tax Portal

The Los Angeles County Property Tax Portal is an essential resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

- Online access: The portal can be accessed online, making it easy for property owners to manage their taxes from anywhere with an internet connection.

- Property tax bills: Property owners can view their property tax bills online and track their payment history.

- Online payments: Property owners can make online payments securely and easily.

- Filing appeals: The portal provides a streamlined process for filing appeals.

- Property tax information: The portal offers a wealth of information about property taxes, including assessment information and tax rates.

- Exemptions and deductions: Property owners can learn about and apply for exemptions and deductions that may reduce their property taxes.

- Tax deadlines: The portal provides clear information about property tax deadlines and penalties for late payments.

- Property: Property owners can access information about their property’s assessed value and how it is determined.

- Tax rates: The portal provides information about the property tax rates in Los Angeles County.

- Contact information: The portal provides contact information for the Los Angeles County Assessor’s office and other helpful resources.

These key aspects make the Los Angeles County Property Tax Portal an invaluable resource for property owners in the county. By providing easy access to important information and online services, the portal helps property owners to manage their tax obligations efficiently and effectively.

Online access

The online accessibility of the Los Angeles County Property Tax Portal is a significant advantage for property owners. It allows them to manage their property tax obligations conveniently and efficiently from any location with an internet connection. This eliminates the need for in-person visits to government offices or the hassle of mailing payments and documents.

- Convenience: Property owners can access the portal 24/7, saving them time and effort compared to traditional methods of property tax management.

- Efficiency: The portal’s user-friendly interface and streamlined processes enable property owners to quickly and easily complete tasks such as viewing bills, making payments, and filing appeals.

- Flexibility: The online accessibility of the portal provides property owners with the flexibility to manage their taxes on their own schedule, without having to adhere to office hours or mailing deadlines.

- Reduced costs: By eliminating the need for postage and in-person visits, the online portal helps property owners save money on expenses related to property tax management.

Overall, the online accessibility of the Los Angeles County Property Tax Portal empowers property owners with greater control and flexibility in managing their property tax obligations.

Property tax bills

The ability to view property tax bills online and track payment history is a key feature of the Los Angeles County Property Tax Portal. It provides property owners with convenient and secure access to important information about their property taxes.

- Convenience: Property owners can access their property tax bills and payment history anytime, anywhere with an internet connection. This eliminates the need to wait for bills to arrive in the mail or visit government offices in person.

- Accuracy: The online portal provides real-time access to the most up-to-date information about property tax bills and payments. This helps property owners avoid errors or discrepancies that may occur with paper bills or manual tracking methods.

- Organization: The portal allows property owners to store and organize their property tax bills and payment records in one secure location. This eliminates the risk of losing or misplacing important documents.

- Payment tracking: The portal provides a clear and detailed record of all payments made towards property taxes. This helps property owners track their payments and ensure that they are up to date on their tax obligations.

Overall, the ability to view property tax bills online and track payment history through the Los Angeles County Property Tax Portal provides property owners with greater convenience, accuracy, organization, and control over their property tax management.

Online payments

The integration of online payments into the Los Angeles County Property Tax Portal is a significant advancement that streamlines the property tax payment process for property owners. It offers several key benefits and plays a crucial role in the overall functionality of the portal.

Convenience and efficiency: Online payments eliminate the need for property owners to write checks or visit payment centers in person. They can make payments from anywhere with an internet connection, at any time of day or night. This convenience saves property owners time and effort, especially those with busy schedules or who live far from payment centers.

Security: The portal utilizes robust security measures to protect sensitive financial information during online payments. Property owners can trust that their transactions are secure and their personal data is safeguarded.

Payment tracking: The portal provides real-time confirmation of payments made. Property owners can track their payment history and view receipts online, ensuring accurate record-keeping and peace of mind.

Reduced costs: Online payments eliminate the need for postage or other expenses associated with mailing payments. This can result in cost savings for property owners over time.

In summary, the online payment feature of the Los Angeles County Property Tax Portal is a valuable component that enhances the overall user experience. It provides property owners with a convenient, efficient, secure, and cost-effective way to fulfill their property tax obligations.

Filing appeals

The integration of a streamlined appeals process into the Los Angeles County Property Tax Portal is a significant feature that empowers property owners to challenge their property tax assessments conveniently and efficiently.

- Simplified procedures: The portal guides property owners through the appeals process with clear instructions and simplified forms, making it easier to understand and complete the necessary steps.

- Online submission: Property owners can submit their appeals online, eliminating the need for physical paperwork or in-person visits to government offices. This saves time and effort, especially for those with busy schedules or limited mobility.

- Evidence upload: The portal allows property owners to upload supporting evidence electronically, such as appraisals, photographs, or other documents that support their appeal. This facilitates the submission of comprehensive appeals and reduces the need for additional requests for information.

- Tracking and updates: The portal provides property owners with the ability to track the status of their appeals online. They can receive updates on the progress of their case and communicate with the relevant authorities through the portal’s messaging system.

By streamlining the appeals process, the Los Angeles County Property Tax Portal empowers property owners to actively participate in the property tax assessment system and seek fair and equitable outcomes. It promotes transparency and accountability, ensuring that property owners have a voice in determining their property tax obligations.

Property tax information

The “Property tax information” section of the Los Angeles County Property Tax Portal is a valuable resource for property owners, providing a comprehensive range of information about property taxes. This information is crucial for property owners to understand their tax obligations, make informed decisions, and navigate the property tax system effectively.

The portal provides detailed assessment information, including the assessed value of the property, the factors considered in determining the assessment, and any exemptions or deductions that may apply. This information helps property owners understand how their property is valued for tax purposes and allows them to identify potential errors or discrepancies in their assessments.

Furthermore, the portal provides up-to-date information on property tax rates, including the base tax rate and any additional rates or assessments that may apply. This information enables property owners to calculate their estimated property tax liability and plan accordingly.

The availability of comprehensive property tax information on the Los Angeles County Property Tax Portal empowers property owners to be proactive in managing their property taxes. They can use this information to assess their tax burden, identify opportunities for tax savings, and make informed decisions about their property.

In conclusion, the “Property tax information” section of the Los Angeles County Property Tax Portal is an essential component that provides property owners with the knowledge and resources they need to navigate the property tax system and fulfill their tax obligations.

Exemptions and deductions

The Los Angeles County Property Tax Portal provides valuable information on exemptions and deductions that property owners may qualify for, enabling them to reduce their property tax burden. These exemptions and deductions are crucial aspects of the property tax system, and the portal empowers property owners to take advantage of them.

- Eligibility and criteria: The portal provides clear guidelines and eligibility criteria for various exemptions and deductions. Property owners can easily determine if they qualify for these tax breaks based on factors such as age, disability, veteran status, or income level.

- Application process: The portal simplifies the application process by providing online forms and instructions. Property owners can conveniently apply for exemptions and deductions without the need for complex paperwork or in-person visits.

- Tax savings: The portal emphasizes the potential tax savings that property owners can achieve by utilizing exemptions and deductions. It provides real-life examples and case studies to demonstrate the financial benefits of these tax breaks.

- Timely filing: The portal reminds property owners of important filing deadlines and encourages them to apply for exemptions and deductions on time to avoid missing out on potential tax savings.

In summary, the “Exemptions and deductions” section of the Los Angeles County Property Tax Portal is a comprehensive resource that empowers property owners to reduce their property taxes. By providing clear information, simplified application processes, and highlighting potential tax savings, the portal plays a crucial role in helping property owners fulfill their tax obligations while minimizing their financial burden.

Tax deadlines

The “Tax deadlines” section of the Los Angeles County Property Tax Portal is a crucial component that assists property owners in fulfilling their tax obligations on time and avoiding penalties. It provides comprehensive and easily accessible information about important property tax deadlines and the consequences of late payments.

- Timely reminders and notifications: The portal sends timely reminders and notifications to property owners as deadlines approach. These reminders help ensure that property owners are aware of upcoming due dates and can make necessary arrangements to make their payments on time.

- Clear and concise deadlines: The portal presents property tax deadlines in a clear and concise manner, making it easy for property owners to understand when their payments are due. This clarity helps property owners avoid confusion or misunderstandings that could lead to late payments.

- Consequences of late payments: The portal also outlines the penalties and consequences associated with late property tax payments. This information serves as a deterrent against procrastination and encourages property owners to prioritize their tax obligations.

- Payment options and extensions: In some cases, the portal provides information about payment options or extensions that may be available to property owners who are facing financial hardship or other circumstances that prevent them from making timely payments.

By providing clear and accessible information about property tax deadlines and penalties for late payments, the Los Angeles County Property Tax Portal empowers property owners to manage their tax obligations responsibly and avoid unnecessary financial burdens.

Property

The “Property” section of the Los Angeles County Property Tax Portal provides property owners with valuable information about their property’s assessed value and how it is determined. This information is crucial for property owners to understand their property tax obligations and make informed decisions about their property.

The assessed value of a property is the basis for calculating property taxes. By providing property owners with access to information about their property’s assessed value and the factors that influence it, the portal empowers them to identify potential errors or discrepancies in their assessments and to challenge them if necessary.

Furthermore, understanding how property values are determined can help property owners make informed decisions about their property. For example, if a property owner knows that their property’s value is likely to increase in the future, they may consider making improvements to the property to further increase its value and, potentially, their return on investment.

Tax rates

The Los Angeles County Property Tax Portal provides valuable information about property tax rates in Los Angeles County, enabling property owners to understand how their property taxes are calculated and how they compare to other properties in the area.

- Property tax rates: The portal provides a clear and concise explanation of property tax rates, including the base tax rate and any additional rates or assessments that may apply. This information helps property owners understand the overall tax burden associated with owning property in Los Angeles County.

- Tax rate areas: The portal allows property owners to search for tax rate areas by address or parcel number. This information is essential for determining the specific property tax rates that apply to a particular property.

- Tax rate history: The portal provides access to historical property tax rates, allowing property owners to track changes in tax rates over time. This information can be useful for understanding how property values and tax burdens have changed in the past and for making informed decisions about future property purchases or investments.

- Tax rate comparisons: The portal allows property owners to compare property tax rates between different areas in Los Angeles County. This information can be helpful for making decisions about where to buy or invest in property, as well as for understanding how tax rates vary across the county.

By providing comprehensive information about property tax rates, the Los Angeles County Property Tax Portal empowers property owners to make informed decisions about their property taxes and to ensure that they are paying the correct amount of taxes. This information is also valuable for researchers, policymakers, and other stakeholders who are interested in understanding the property tax system in Los Angeles County.

Contact information

The “Contact information” section of the Los Angeles County Property Tax Portal is a crucial component that connects property owners with the necessary resources and support they may need regarding their property taxes. This section provides a comprehensive list of contact information for the Los Angeles County Assessor’s office and other helpful organizations.

The Los Angeles County Assessor’s office is responsible for assessing the value of properties within the county and determining their property taxes. By providing direct contact information for the Assessor’s office, the portal empowers property owners to easily reach out to the appropriate department for inquiries, clarifications, or appeals related to their property tax assessments.

In addition to the Assessor’s office, the portal also includes contact information for other helpful resources, such as property tax consultants, legal aid organizations, and homeowner assistance programs. These resources can provide valuable guidance and support to property owners who may need assistance with understanding property tax laws, navigating the appeals process, or accessing financial aid programs.

The accessibility of contact information through the Los Angeles County Property Tax Portal plays a vital role in ensuring that property owners have the necessary support and resources to fulfill their tax obligations and protect their property rights. This information empowers property owners to actively engage with the property tax system, seek clarification when needed, and access assistance when facing challenges.

Frequently Asked Questions about the Los Angeles County Property Tax Portal

The Los Angeles County Property Tax Portal is an online platform that provides property owners in Los Angeles County with access to information about their property taxes, make payments, and file appeals. The portal is designed to provide a user-friendly and efficient way for property owners to manage their tax obligations.

Here are answers to some frequently asked questions about the portal:

Question 1: How do I access the Los Angeles County Property Tax Portal?

You can access the portal by visiting the Los Angeles County Assessor’s website at https://assessor.lacounty.gov/.

Question 2: What information can I find on the portal?

The portal provides a range of information about property taxes, including property tax bills, payment history, assessment information, tax rates, and exemptions.

Question 3: Can I make property tax payments online?

Yes, you can make online payments securely and easily through the portal.

Question 4: How do I file an appeal if I disagree with my property tax assessment?

You can file an appeal online through the portal. The portal provides a streamlined process for filing appeals and tracking their status.

Question 5: What if I need help using the portal?

The portal provides a help section with frequently asked questions and contact information for the Assessor’s office.

Question 6: Is the portal secure?

Yes, the portal uses robust security measures to protect your personal and financial information.

These are just a few of the frequently asked questions about the Los Angeles County Property Tax Portal. For more information, please visit the Assessor’s website.

The Los Angeles County Property Tax Portal is a valuable resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

To learn more about the portal and other property tax-related topics, continue reading the following sections of this article.

Tips for Using the Los Angeles County Property Tax Portal

The Los Angeles County Property Tax Portal is a valuable resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

Here are a few tips to help you make the most of the portal:

Tip 1: Create an account. Creating an account on the portal will allow you to save your information and track your property tax payments and appeals. It will also give you access to additional features, such as the ability to view your property tax bill online and receive email notifications about important deadlines.

Tip 2: Keep your information up to date. It is important to keep your contact information and property ownership information up to date on the portal. This will ensure that you receive important notices and communications from the Assessor’s office.

Tip 3: Use the portal to make payments. Making property tax payments online is a quick and easy way to avoid late fees and penalties. The portal accepts a variety of payment methods, including credit cards, debit cards, and electronic checks.

Tip 4: File appeals online. If you disagree with your property tax assessment, you can file an appeal online through the portal. The portal provides a streamlined process for filing appeals and tracking their status.

Tip 5: Contact the Assessor’s office for help. If you need help using the portal or have questions about your property taxes, you can contact the Assessor’s office by phone, email, or mail.

By following these tips, you can make the most of the Los Angeles County Property Tax Portal and ensure that you are meeting your property tax obligations.

To learn more about the portal and other property tax-related topics, continue reading the following sections of this article.

Conclusion

The Los Angeles County Property Tax Portal is a valuable resource for property owners in the county. It provides a convenient and efficient way to manage property tax obligations and access important information about property taxes.

The portal offers a range of features, including the ability to view property tax bills, make payments, file appeals, and access a variety of property tax-related resources. These features make the portal an essential tool for property owners in Los Angeles County.

To learn more about the portal and other property tax-related topics, please visit the Assessor’s website at https://assessor.lacounty.gov/.

The post Unveiling the Secrets of Property Tax in Los Angeles County appeared first on Todays News.

]]>