FAQ

This section addresses frequently asked questions regarding the process of calculating auto loan payments using Carvana’s Instant Pre-Approval Tool.

How to Calculate Auto Loan Payments (with Pictures) – wikiHow – Source www.wikihow.com

Question 1: What information is required to use the Instant Pre-Approval Tool?

The tool requires basic personal information, such as name, address, and Social Security number, along with details about the desired vehicle and loan terms.

Question 2: How long does it take to receive pre-approval?

Pre-approval is typically granted within minutes of submitting the necessary information.

Question 3: Does pre-approval guarantee loan approval?

Pre-approval is not a final loan approval but rather an estimate based on the provided information. Final approval depends on factors such as credit history and verification of income.

Question 4: How does the tool determine the loan payment amount?

The tool calculates the monthly payment based on the loan amount, interest rate, and loan term. It considers these factors to provide an accurate estimate.

Question 5: What are the benefits of using the Instant Pre-Approval Tool?

The tool simplifies the loan application process, provides a personalized estimate, and enables users to explore different loan options.

Question 6: Where can I find the Instant Pre-Approval Tool?

The tool is easily accessible on Carvana’s website, providing a convenient way to calculate loan payments at any time.

In summary, Carvana’s Instant Pre-Approval Tool offers a quick and user-friendly way to estimate auto loan payments. By providing accurate information, individuals can gain valuable insights into their auto financing options.

Moving on to the next section, we will explore the advantages and considerations of using Carvana’s Instant Pre-Approval Tool.

Tips

To ease the process of auto loan payment calculation, consider utilizing Calculate Your Auto Loan Payment With Carvana’s Instant Pre-Approval Tool. This tool provides accurate estimates based on factors such as loan amount, loan term, and interest rate.

Tip 1: Gather essential loan information

Determine the principal loan amount, loan period in months, and estimated interest rate. These details are crucial for accurate payment estimation.

Tip 2: Utilize an online auto loan calculator

Several reputable websites offer free auto loan calculators that simplify the calculation process. Input the gathered loan information and obtain instant payment estimates.

Tip 3: Understand loan terminology

Familiarize yourself with terms like principal, interest, and loan term to make informed decisions regarding loan repayment.

Tip 4: Consider the impact of down payment

A larger down payment can lower the overall loan amount, resulting in reduced monthly payments.

Tip 5: Explore refinancing options

If interest rates decline after obtaining a loan, consider refinancing to secure a lower interest rate and potentially save money on monthly payments.

Summary:

By following these tips and utilizing the Calculate Your Auto Loan Payment With Carvana’s Instant Pre-Approval Tool, you can confidently estimate and manage your auto loan payments.

Calculate Your Auto Loan Payment With Carvana’s Instant Pre-Approval Tool

Carvana’s Instant Pre-Approval Tool streamlines the auto financing process by providing essential information for a car loan, making it convenient and transparent.

- Convenient Calculation: Estimate your monthly loan payments in real-time, empowering you with financial clarity.

- Personalized Terms: Tailor your loan to suit your budget and preferences, ensuring a customized experience.

- Instant Pre-Approval: Receive loan offers instantly without the hassle of credit checks, expediting the car-buying journey.

- Simplified Process: Eliminate the need for lengthy applications and paperwork, reducing the time and effort involved.

- Transparency and Clarity: Gain clear insights into your loan terms, including interest rates and repayment timelines, fostering trust.

- Empowered Decision-Making: The tool equips you with the knowledge and insights to make informed choices about car financing.

Navigating the complexities of auto financing can be daunting, but Carvana’s Instant Pre-Approval Tool simplifies the process by providing convenient calculations, personalized terms, and instant pre-approvals. It streamlines the journey toward car ownership by minimizing paperwork, maximizing transparency, and empowering informed decision-making. Whether you’re a first-time car buyer or a seasoned professional, this tool provides a seamless and efficient experience.

How to Refinance an Auto Loan: 15 Steps (with Pictures) – wikiHow – Source www.wikihow.com

Calculate Your Auto Loan Payment With Carvana’s Instant Pre-Approval Tool

Carvana’s Instant Pre-Approval Tool allows you to get an auto loan without having to visit a dealership. This tool can save you time and hassle, and it can also help you get a better interest rate on your loan.

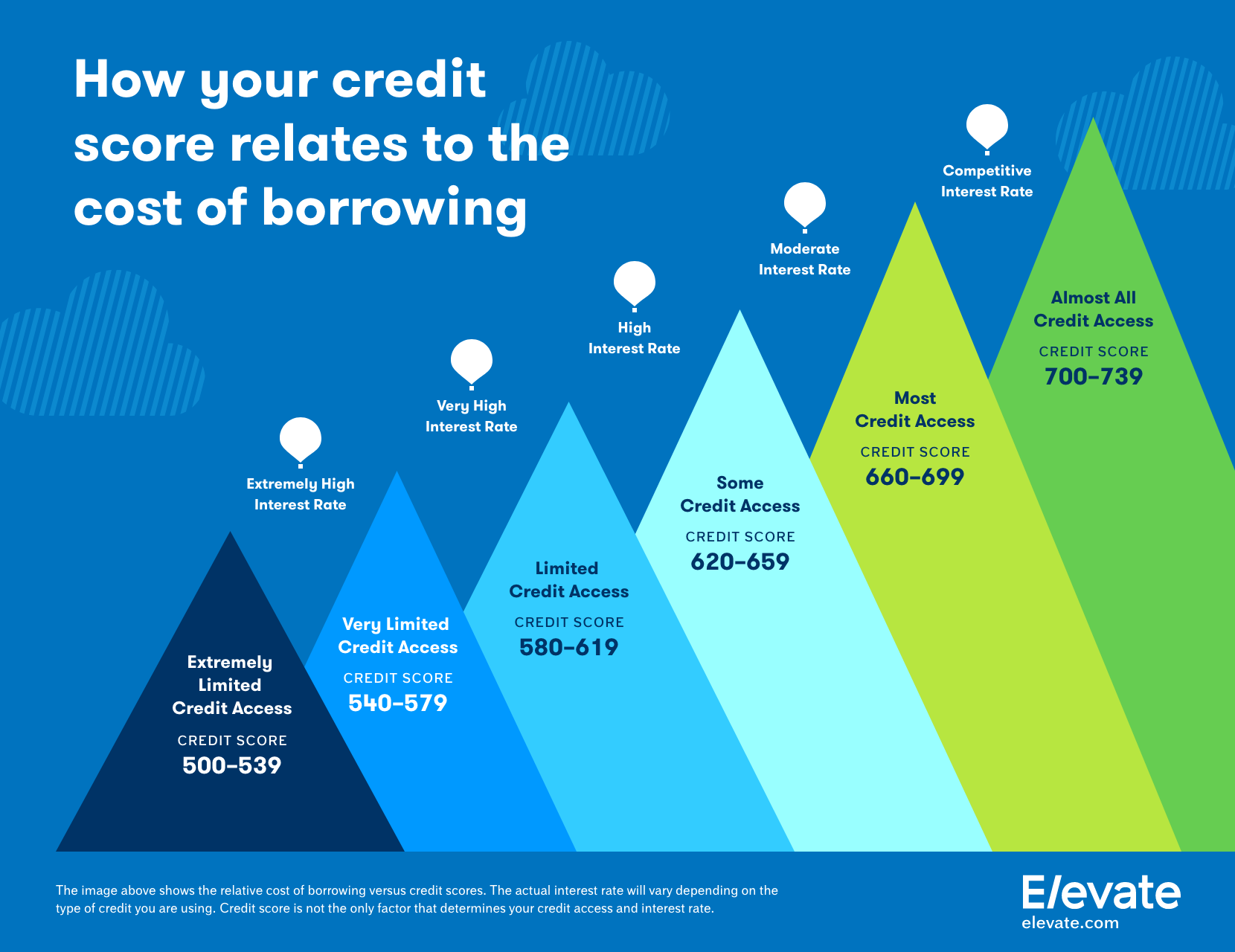

What interest rate can I get with a 580 credit score? Leia aqui: Can I – Source fabalabse.com

To use the tool, you’ll need to provide some basic information, including your name, address, and Social Security number. You’ll also need to provide information about the car you want to buy, including the make, model, and year. Once you’ve provided this information, Carvana will give you an instant pre-approval decision.

If you’re pre-approved, you can then start shopping for a car. Once you’ve found a car you like, you can use your pre-approval to get financing. This will make the financing process easier and faster.

There are several benefits to using Carvana’s Instant Pre-Approval Tool. First, it can save you time. By getting pre-approved, you can skip the step of applying for a loan at a dealership. This can save you hours of time.

Second, it can save you money. By getting pre-approved, you can get a better interest rate on your loan. This can save you hundreds of dollars over the life of your loan.

Third, it can give you peace of mind. By getting pre-approved, you’ll know how much you can afford to spend on a car. This can help you avoid getting into debt over your head.

Conclusion

Carvana’s Instant Pre-Approval Tool is a valuable tool for anyone who is looking to buy a car. It can save you time, money, and hassle. If you’re planning to buy a car, be sure to use this tool to get pre-approved for a loan.

By getting pre-approved, you’ll be able to start shopping for a car with confidence. You’ll know how much you can afford to spend, and you’ll be able to get the best possible interest rate on your loan.